Medically Reviewed by: Dr. Fatih Safar , Yeni Yüzyil University Dental Medicine | Aydin University Doctorate of Jaw surgery

Last Updated: Current Month 2025/2026| Reading Time: 8 minutes

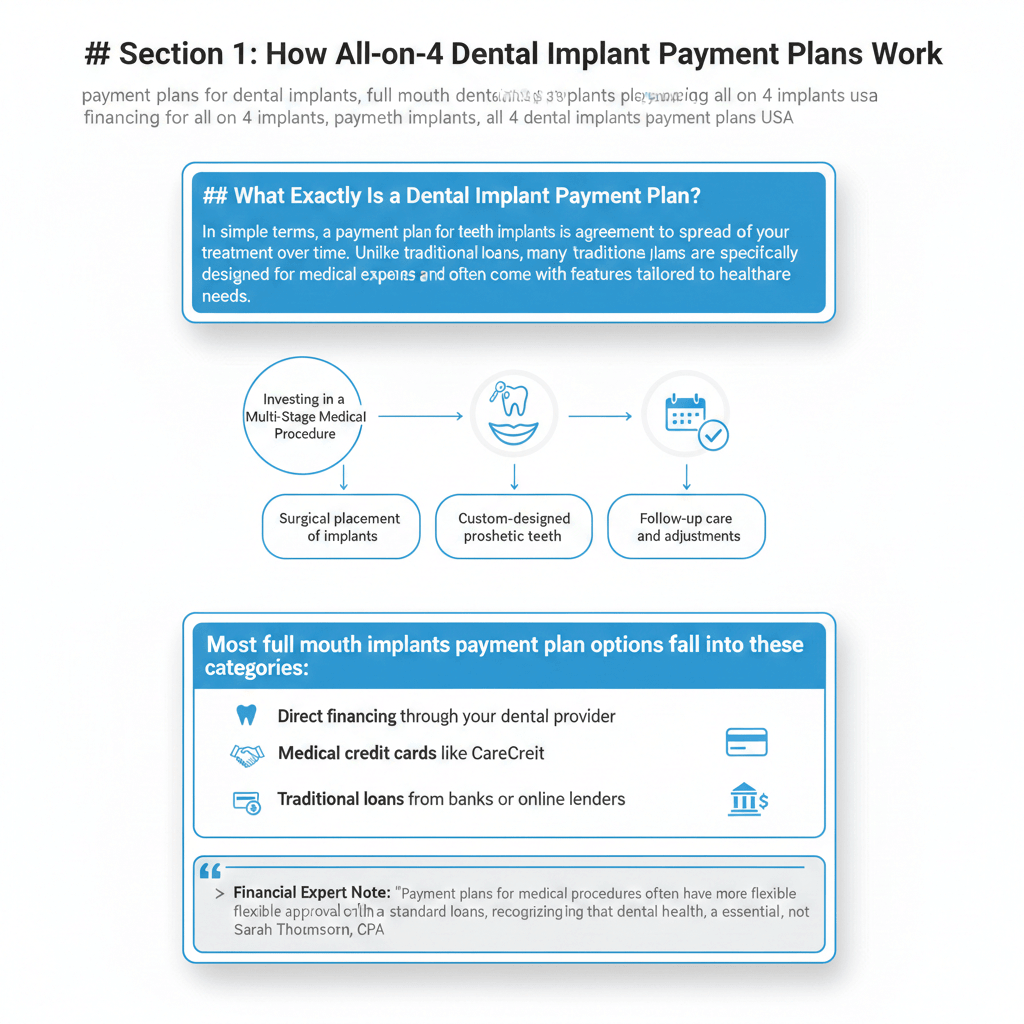

Direct Answer: All-on-4 dental implants payment plans in 2026 typically consist of three main avenues: in-house clinic financing for those seeking a dental implants payment plan with no credit check (soft pull), medical credit cards like CareCredit for interest-free dental implants payment plans, and specialized full mouth dental implants payment plans through lenders like Proceed Finance.

If you’re researching all on 4 dental implants payment plans, you’re joining thousands of Americans navigating the financial pathway to a restored smile. Many patients begin by learning about our dental implants services and understanding the which types of dental implants may be recommended for their condition before exploring financing.

Understanding your payment plan for teeth implants options is crucial for making this important healthcare decision accessible. This guide breaks down everything you need to know about financing for all on 4 implants in clear, actionable terms—so you can move forward with confidence.

Key Insight from Dr. Miller: “The right payment plan should feel like a partnership, not a burden. When patients understand their options upfront, they can focus on healing rather than worrying about finances.”

Ready to start your smile transformation? Get pre-approved for financing in 60 seconds and 👉 check your financing options here or 📅 schedule your FREE consultation today to begin your journey.

Table of Contents

ToggleUnderstanding Your All-on-4 Dental Implants Financing Options

When patients ask, “Can you finance All-on-4 dental implants?” the answer is a resounding yes. In fact, most financing for All-on-4 implants is structured to handle the significant full arch restoration cost by breaking it into manageable monthly payment dental implants.

Typical Payment Plan Options for All-on-4 Dental Implants

To compare monthly payment plans for All-on-4 implants from top providers, you must understand the three distinct tiers of the All-on-4 dental implants payment plans USA market:

Direct Clinic Solutions: Many patients prefer in-house financing dental implants because the office manages the fixed-rate installments directly. This is often the cheapest place to get All-on-4 dental implants because you avoid third-party banking fees.

Specialized Medical Lenders: Top dental implant companies with payment plans (such as Proceed or United Medical Credit) offer unsecured medical loans based on your debt-to-income ratio rather than just a FICO score.

Promotional Credit: If you have a high credit score to finance dental implants (680+), you can utilize interest-free dental implants payment plans for up to 24 months.

Types of All-on-4 Payment Plans (Overview)

What are the typical payment plan options for all on 4 dental implants?

When patients ask about all on 4 dental implants financing, I explain there are three main pathways, each with distinct characteristics for managing all on 4 dental implants monthly payments.

The Three Main Avenues:

1. Clinic-Managed Payment Plans

These monthly payment dental implants options are arranged directly through your dental office. The practice either extends credit themselves or partners with specialized medical financing companies.

2. Medical Credit Solutions

Companies like CareCredit provide credit specifically for healthcare expenses, often featuring promotional periods with no interest if paid within a set timeframe.

3. Traditional Financing Options

Banks, credit unions, and online lenders offer personal loans that can be used for dental work, providing fixed payments over set terms.

Dr. Miller’s Perspective: “Each patient’s situation calls for a different approach. Some need the simplicity of one-stop financing through our office, while others benefit from shopping multiple lenders for the best rates.”

Get Your Treatment Plan: Schedule a consultation with a qualified dentist to receive a detailed treatment plan and the total financing amount needed. To estimate these figures beforehand, we recommend reviewing our complete All-on-4 price guide. This is the first step in the process to get your smile back fast.

Direct Comparison: In-House vs. Medical Credit vs. Personal Loans

Before diving into the details, here’s a quick-reference comparison table that highlights how each financing avenue stacks up:

| Feature | In-House Financing | Medical Credit (CareCredit) | Personal/Medical Loan |

|---|---|---|---|

| Typical APR | 0% – 12% (promotional) | 0% (Promo) / 26.99%+ (Standard) | 6% – 18% |

| Best For | Low Credit Scores & Convenience | Short-term payoff (12-24 months) | Long-term planning (3-7 years) |

| Credit Impact | Often Soft Pull | Hard Inquiry | Hard Inquiry |

| Max Amount | Varies by Clinic | Credit Limit Dependent | Up to $100k |

| Approval Speed | Same-day to 24 hours | 1-3 business days | 2-7 business days |

| Provider Flexibility | Single clinic only | Thousands of providers | Any provider accepts cash |

| Payment Structure | Fixed monthly amounts | Minimum payments during promo | Fixed monthly installments |

CPA Analysis: “This table shows why one-size-fits-all advice doesn’t work for dental financing. A patient with excellent credit benefits from personal loan rates, while someone needing immediate treatment might accept higher APR for in-house convenience.” – Sarah Thompson

Not sure which financing option is best for you?Take our 90-second financing quiz for a personalized recommendation tailored to your credit and budget.

In-House Dental Implant Payment Plans

The Convenience of Direct Clinic Financing

In house financing dental implants represents the most straightforward path to dental implants with payment plans. When a practice offers dental office payment plans, they’re providing a direct path to treatment without involving external lenders.

How It Typically Works:

Application: Simple form during your consultation

Approval: Often while you’re still at the office

Structure: Regular dental implants pay monthly amounts over 12-48 months

Management: All payments made directly to the dental office

Understanding “No Credit Check” Claims

Many clinics advertise dental implants payment plan no credit check options. Here’s what that typically means in practice:

The Reality:

Most providers perform a “soft check” that doesn’t affect your credit score

They’re looking for major red flags, not perfect credit history

Terms may be adjusted based on limited credit information

Why Choose In-House Financing?

Speed: Treatment can often begin immediately

Simplicity: One point of contact for both treatment and payment

Flexibility: Some practices offer payment adjustments based on circumstances

Relationship: Direct communication with the office about payment questions

Considerations:

Availability: Not all practices offer their own financing

Terms Vary: Each practice sets their own policies

Geographic Limitations: Usually tied to that specific practice location

CareCredit & Promotional Dental Implant Payment Plans

Understanding CareCredit Payment Plans for All-on-4

These financing options are typically finalized after completing a personalized treatment planning session based on your all on 4 dental implants procedure requirements.

CareCredit for All-on-4 has become one of the most widely used options for managing dental expenses through structured payment arrangements. As a specialized medical credit card for dental implants, it functions differently from traditional credit cards and requires specific understanding of its promotional features.

How CareCredit Payment Plans Work:

Promotional Period Structure:

6-24 months of no interest if the balance is paid in full during the promotional period

Standard rates apply if any balance remains after the promotion ends

Minimum monthly payments are required even during promotional periods

The Critical Detail Most Patients Miss:

The interest free dental implants payment plans offered by CareCredit use “deferred interest.” This means if you don’t pay the full balance during the promotional period, interest may be charged back to the original amount financed.

Dr. Miller’s Advice: “Set calendar reminders for your promotional period end date. I’ve helped many patients avoid unexpected interest charges by planning their payoff strategy from day one.”

Why CareCredit Remains Popular for dental financing with 0% APR:

Wide Provider Acceptance: Accepted at thousands of dental practices nationwide

Flexible Promotional Terms: Different timeframes based on treatment amount

Healthcare-Specific Design: Created specifically for medical and dental expenses

Reusable Credit: Can be used for future dental or medical needs

Managing CareCredit Effectively:

Best Practices:

Calculate the monthly payment needed to pay in full before the promotional period ends

Set up automatic payments to avoid missing deadlines

Keep the promotional end date visible on your calendar

Consider setting aside funds specifically for the payoff amount

Common Mistakes to Avoid:

Making only minimum payments during promotional periods

Forgetting about the promotional deadline

Assuming the promotional period automatically renews

Not reading the terms about deferred interest

Limited time offer: Some CareCredit providers are offering extended 0% APR periods for All-on-4 procedures. Check current offers before they expire!

Navigating Credit & Eligibility in 2026

A common concern is: “What credit score do you need to finance dental implants?” While prime lenders look for 650+, specialized all on 4 dental implants financing providers now accept scores as low as 550.

Can I get All-on-4 dental implants with no money down payment plans?

Yes, but with specific caveats. True All-on-4 implants no money down options are generally reserved for those with strong credit profiles or high-income stability. If you are navigating a lower credit score, we recommend looking for dental clinics that offer financing for All-on-4 implants with a structured “Hybrid Plan.” This typically involves a small initial deposit to cover lab fees—detailed in our breakdown of Same-Day All-on-4 costs—followed by low, predictable monthly payments.

CPA Insight: “When evaluating how people finance dental implants, always check for a soft credit pull pre-qualification. This allows you to see your all on 4 dental implants monthly payments without impacting your credit report.” – Sarah Thompson, CPA

Personal & Medical Loan Payment Plans for All-on-4

Beyond the Dental Office: Traditional Lending Options

When exploring dental implant companies with payment plans, you’ll find that personal loans for dental implants offer a different approach. These medical loans for All-on-4 are typically unsecured loans for dental work, meaning no collateral is required.

Lenders Specializing in Medical Financing:

Several companies position themselves specifically as dental implant companies with payment plans:

Specialized Medical Lenders:

Proceed Finance: Works directly with healthcare providers

United Medical Credit: Focuses exclusively on medical/dental procedures

Advantage Credit: Offers healthcare-specific financing options

Traditional Lenders Also Offering Medical Loans:

Major banks and credit unions

Online lending platforms

Peer-to-peer lending networks

How These Options Work:

Typical Process:

Application: Online or in-person application

Approval Decision: Usually within 1-3 business days

Funding: Money sent to you or directly to provider

Repayment: Fixed monthly payments over 2-7 years

Key Characteristics:

Fixed Rates: Monthly payment stays the same

Set Terms: Clear beginning and end dates

Direct Control: You manage the relationship with the lender

CPA Perspective: “Traditional loans often provide clearer long-term payment visibility than promotional credit options. You know exactly what you’ll pay each month for the entire term.” – Sarah Thompson

Advantages of Personal/Medical Loans:

Rate Stability: Fixed interest rates for predictable budgeting

Provider Freedom: Can use with any qualified dental provider

Clear Terms: No promotional periods to manage

Credit Building: Regular payments can improve credit score

Considerations:

Approval Process: May require more documentation than other options

Credit Impact: Application involves a credit check

Comparison Shopping: Requires research across multiple lenders

Finding All-on-4 Dental Implant Payment Plans Near You

A common concern for many patients is: “What credit score do you need to finance dental implants?” While prime lenders typically look for a 650+ score, the 2026 lending landscape has expanded. Specialized All-on-4 dental implants financing providers now utilize alternative data—such as banking history and income stability—to accept scores as low as 550.

Can I get All-on-4 dental implants with no money down payment plans?

Yes, but with specific caveats. True All-on-4 implants no money down options are generally reserved for those with strong credit profiles or high-income stability. If you are navigating a lower credit score, we recommend looking for dental clinics that offer financing for All-on-4 implants with a structured “Hybrid Plan.” This typically involves a small initial deposit to cover lab fees, followed by low, predictable monthly payments.

CPA Insight: “In 2026, the best way to shop for dental financing is through a ‘soft credit pull’ pre-qualification. This allows you to see your exact All-on-4 dental implants monthly payments and APR without any impact on your credit report.” – Sarah Thompson, CPA

How to Apply for an All-on-4 Payment Plan: Step-by-Step Checklist

Follow these 7 steps to successfully apply for your All-on-4 payment plan

Schedule a consultation with a qualified dentist to receive a detailed treatment plan and the total financing amount needed.

Review your current credit score to understand which financing options you’re likely to qualify for and at what rates.

Collect recent pay stubs, tax returns, and identification documents you’ll need for most financing applications.

Submit applications to 3-4 lenders within 14 days (using soft checks when available) to compare offers without multiple credit impacts.

Evaluate each offer based on APR, total payment obligation, monthly payment amount, and repayment terms.

Choose your preferred option and submit the complete application with all required documentation.

Carefully read all terms and conditions before signing your payment plan agreement.

Final Guidance – Choosing the Right Payment Plan

Making Your Decision with Confidence

After exploring all dental implant financing options, use this approach to select the best payment plans for dental implants for your unique situation.

Reviewing before and after All-on-4 results can help you feel more confident about committing to a long-term payment plan.

Decision Framework:

For Those Prioritizing Simplicity:

Consider: In-house clinic financing

Why: Single point of contact, integrated with treatment

Best for: Patients who value convenience and direct provider relationships

For Those Seeking Promotional Terms:

Consider: Medical credit cards with 0% periods

Why: Opportunity for interest-free financing

Best for: Disciplined patients who can pay within promotional periods

For Those Wanting Maximum Flexibility:

Consider: Traditional personal loans

Why: Fixed terms, provider choice freedom

Best for: Patients who want to compare multiple providers

Your Final Checklist:

Before Committing, Verify:

Total Payment Obligation Understanding: You know exactly what you’re committing to pay

Terms Clarity: All conditions are explained in understandable language

Provider Confidence:You trust your dentist’s clinical skills to avoid the complications detailed in our guide to the honest truth about All-on-4 risks and problems.

Budget Alignment: Payments fit comfortably within your financial picture

Plan Understanding: You know what happens if circumstances change

Financing Your Full Mouth Restoration

How do I apply for a payment plan for All-on-4 dental implants? Most clinics offer a 60-second digital application during your initial consultation. You will need your income details and basic ID to check what credit requirements companies have for All-on-4 implant financing.

Can you make payments on full dental implants? Yes. You can pay monthly for dental implants through structured loans lasting 12 to 96 months.

Do dental insurance plans typically cover All-on-4 implants or their payment plans? Most dental insurance plans treat All-on-4 as “major restorative” or “cosmetic,” covering only $1,500–$2,500. This is why a full mouth dental implants payment plan is essential to cover the remaining balance.

Final Combined Advice: “The ideal payment plan serves your health needs while respecting your financial reality. It should feel sustainable throughout your treatment and recovery. Don’t hesitate to ask questions until you’re completely comfortable with your choice.” – Dr. Miller & Sarah Thompson

Immediate Next Steps:

You can visually preview outcomes and healing progress in our before and after All-on-4 dental implants gallery before scheduling.

Schedule Consultations with recommended providers

Request Financing Information during consultations

Compare Options using the framework above

Take Time to Decide – this is a significant commitment

Proceed with Confidence once you’ve made your choice

About Our Reviewers:

Medically Reviewed by: Dr. Fatih Safar , Yeni Yüzyil University Dental Medicine | Aydin University Doctorate of Jaw surgery

This content is regularly reviewed and updated to reflect current practices and options in dental implant financing.

Disclaimer: This guide provides educational information about dental implant payment options. It does not constitute financial or medical advice. Consult with qualified financial and dental professionals before making decisions about dental treatment and financing. Options, terms, and availability vary by individual circumstances and location.

Can you finance All-on-4 dental implants?

Yes — most clinics offer financing for this procedure. Many patients use all on 4 dental implants payment plans through in-house financing, medical lenders, or third-party credit services. Approval depends on credit and income, but fixed monthly options are common.

How long do you go without teeth when getting implants?

With the All-on-4® protocol, you usually don’t go without teeth at all. Temporary teeth are placed the same day, and you later return for your final bridge. Clinics that provide dental implants near me with payment plans can explain how the temporary stage works.

Can I get dental implants and pay monthly?

Yes — many clinics allow all on 4 dental implants monthly payments depending on approval. Monthly terms vary from 6 to 60 months, and options include medical loans or in-house split payments. Always request a written financing breakdown before committing.

Can I pay monthly to get my teeth done?

Yes, especially for full-arch cases. A full mouth dental implants payment plan can reduce the upfront cost and spread the investment over predictable monthly installments. Ask for the APR, interest-free options, and prepayment policies.

Can dental implants be paid in installments?

Yes — implants can be financed like other medical treatments. Some clinics offer monthly payment dental implants with fixed interest, while others partner with lenders like CareCredit or banks. Approval rules vary, but installment payments are widely available.